What is USD1? Who’s really behind it? And why does it matter right now?

Those are the questions that a lot of crypto folks are asking this week.

A new stablecoin, USD1, just quietly appeared on BNB Chain and Ethereum. It didn’t come with an official launch. No press release. No announcement from the team. Not even a single tweet from the people allegedly tied to it.

So what’s going on here?

A Stablecoin… With Political Luggage?

The project is called World Liberty Financial (WLFI). On-chain data shows they recently deployed the USD1 smart contract on both BNB Chain and Ethereum.

But here’s where things get kinda strange — and maybe a bit messy.

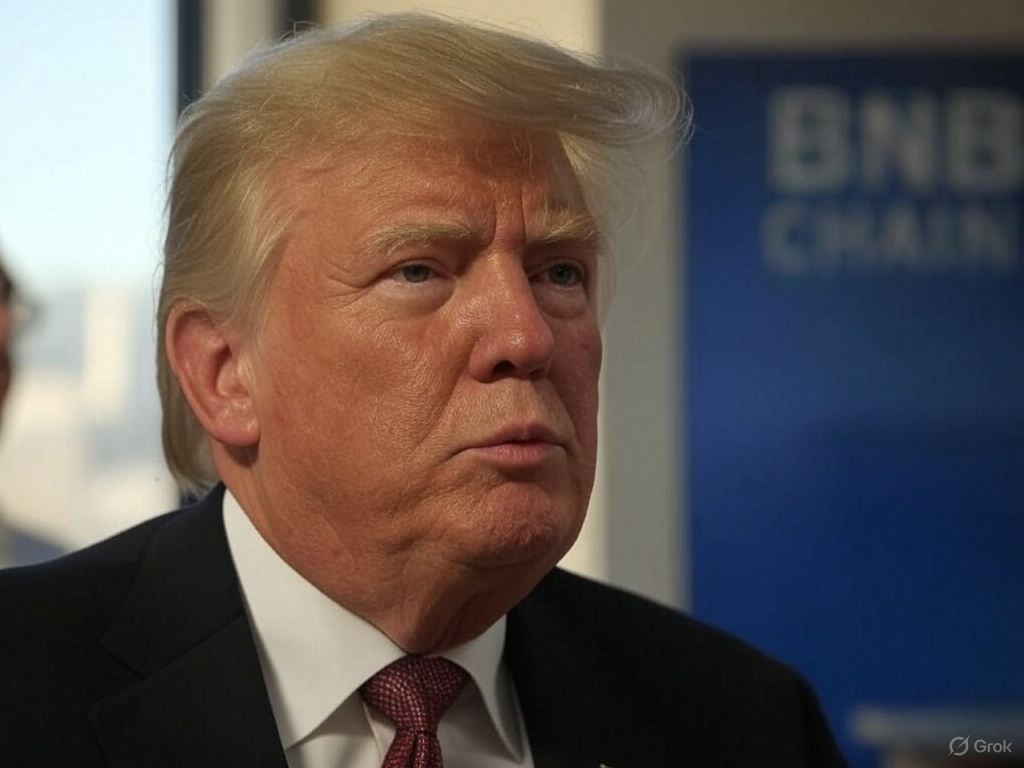

Reports say WLFI might be connected to the Trump family. Yeah, that Trump family. If it’s true, that makes USD1 the first stablecoin with direct political ties to a major U.S. political figure. That alone makes people nervous, curious, or just confused.

No official source has confirmed the Trump link. But the rumors are spreading. And in crypto, rumors move markets.

Why Did Wintermute Touch It?

Not long after the smart contract went live, some sharp eyes noticed that Wintermute, one of the biggest market makers in crypto, was involved in early test transactions with USD1.

Why would a heavyweight like Wintermute mess with an unknown coin like USD1?

That’s not something they usually do for fun. It doesn’t confirm a partnership, but it does say one thing loud: this coin is on somebody’s radar.

Still, no one has traded it publicly. No listings. No liquidity pools. Just some quiet wallet activity and a lot of guesswork.

What Is This Coin Even Supposed To Do?

Good question.

WLFI hasn’t said if USD1 is fiat-backed, crypto-collateralized, or algorithmic. There’s no whitepaper. No proof of reserves. Not even a blog post. That leaves people asking the same thing:

“If I hold this coin, what actually backs it?”

For now, there’s no answer.

How Does USD1 Stack Up?

Let’s be real. USD1’s stepping into a tough neighborhood. USDT, USDC, and DAI basically run the stablecoin world.

| Feature | USD1 | USDT | USDC | DAI |

|---|---|---|---|---|

| Issuer | WLFI (Trump-linked?) | Tether Ltd. | Circle | MakerDAO |

| Chains | BNB, Ethereum | Many | Many | Ethereum |

| Backing | Unknown | Fiat | Fiat | Crypto overcollateral |

| Transparency | None yet | Low | High | Decentralized |

| Use Case | DeFi? TBD | Trading | Institutions | DeFi / censorship res |

So, what’s the point of USD1?

It seems like WLFI wants to bring new liquidity into DeFi. They might be aiming to plug USD1 into lending platforms. Or maybe tap into BNB Chain’s $100 million liquidity program.

If that’s the case, then they better start talking soon. Because right now, the silence is louder than the launch.

Is This a Real Project or Just a PR Play?

Here’s the problem — nobody knows.

There are three ways this could go:

- It’s real, but early. WLFI could be testing things out before launching big.

- It’s symbolic. Maybe it’s more of a political move than a financial product.

- It’s sketchy. With no transparency or roadmap, it might be a trap.

In crypto, all three are possible. And it wouldn’t be the first time a project tried to cash in on politics or fame.

But here’s the truth: without a reserve audit or team communication, most serious investors won’t touch it.

So… Should You Care About USD1?

If you’re in DeFi or follow stablecoins, yeah — you should probably pay attention.

Not because it’s good or bad. Not yet. But because a stablecoin tied to political power is a new kind of player. That’s not something we’ve seen before at this level.

Maybe it never takes off. Or maybe it quietly grows behind the scenes. But either way, it says something big:

Crypto is moving closer to the political frontlines.

And that means everything changes from here.

Want help tracking the next stablecoin to watch? Or looking for safer plays in DeFi? Drop me a note, and I’ll keep you posted.

Let’s see what WLFI does next.