What if the next big crypto move isn’t a meme coin? What if it’s something… real?

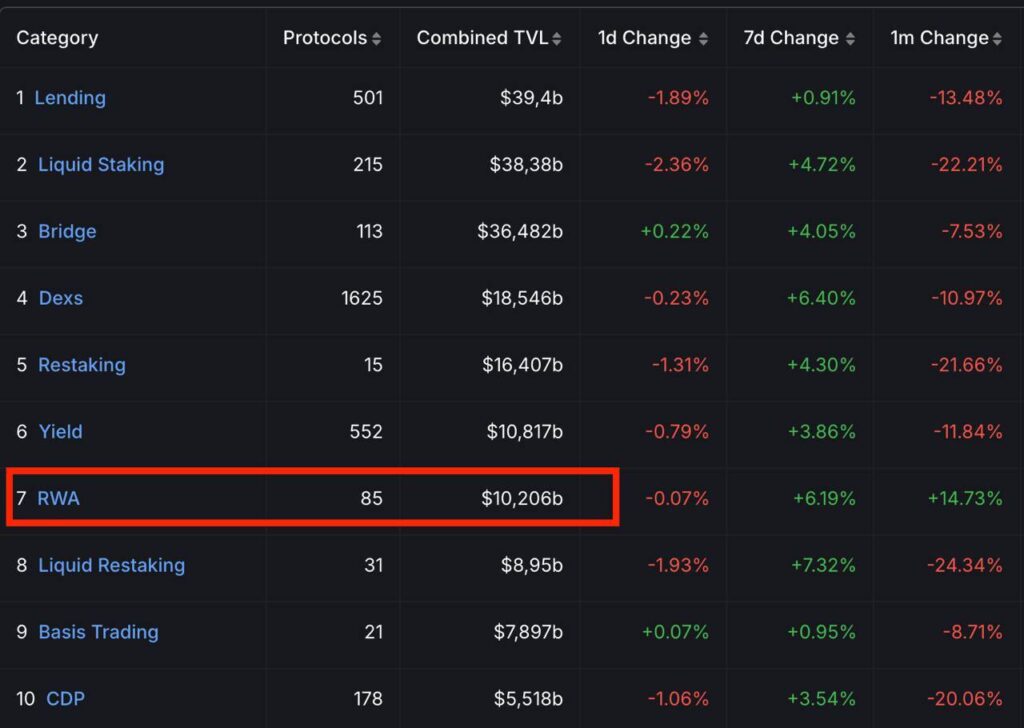

Right now, something is happening behind the noise. While everyone’s watching charts bounce up and down, a quieter shift is taking place. Real-world assets — also called RWAs — are making their way on-chain. And they just passed $10 billion in total value locked (TVL).

Let that number sink in for a sec. $10 billion, not in hype, not in promises. But in tokenized real estate, U.S. treasuries, stocks, commodities — actual stuff.

But what are RWAs really? And why should you care?

RWAs are just what they sound like — assets from the real world, like real estate or bonds, turned into tokens that live on the blockchain. You can own a piece of a building. Or part of a government bond. All without the red tape or needing a million dollars to start.

They let you buy, sell, and trade traditional assets instantly, without banks, middlemen, or waiting days for settlement. And they offer fractional ownership, which means you don’t need to go all in. You can own just a slice.

So why now? Why are RWAs blowing up?

Because people are tired of volatility. RWAs give something crypto hasn’t really had — stability. Treasury-backed tokens, especially, are flying. Over $4.2 billion in the market now comes from these more stable, yield-bearing assets. Think Ondo Finance’s OUSG or Franklin Templeton’s BENJI. Both are getting major attention from institutions.

And then there’s Ethena’s USDtb — it saw a 1,000% spike in TVL in just a month. That’s not a typo.

Which protocols are leading the charge? You’ve probably heard some of these names. Maker RWA, BlackRock’s BUIDL, Ondo Finance, and Ethena — all now with over $1 billion TVL each. That’s not small. These aren’t unknown DeFi experiments. They’re becoming core parts of the ecosystem.

And this trend? It’s not slowing down.

According to DeFiLlama, on-chain RWAs went from $15.43 billion to $18.18 billion this year alone. That’s fast.

And some analysts say the RWA market could cross $50 billion by the end of 2025. The World Economic Forum even expects up to 10% of global GDP — about $24 trillion — to be tokenized by 2027.

You might be wondering — okay, sounds good. But isn’t this gonna hit a wall with regulators?

Yes, compliance is still a challenge. But that’s where partnerships like RWA Inc. and Novastro come in. They’re using AI to improve security and compliance in asset tokenization. They’re building the rails that let TradFi and DeFi actually work together.

That’s the story here. RWAs aren’t hype. They’re a bridge — connecting old finance with new systems. And that bridge is already being walked on by institutions. The smart ones, anyway.

So what does this mean for you?

It means there’s a shift happening. And if you’re only watching for the next altcoin pump, you might miss it.

RWAs are changing what crypto can do — not just how fast it can moon.

It’s no longer just about buying coins. It’s about owning real stuff, in smarter ways, with less friction, on your terms.

The door is open now. The question is — are you walking through it?