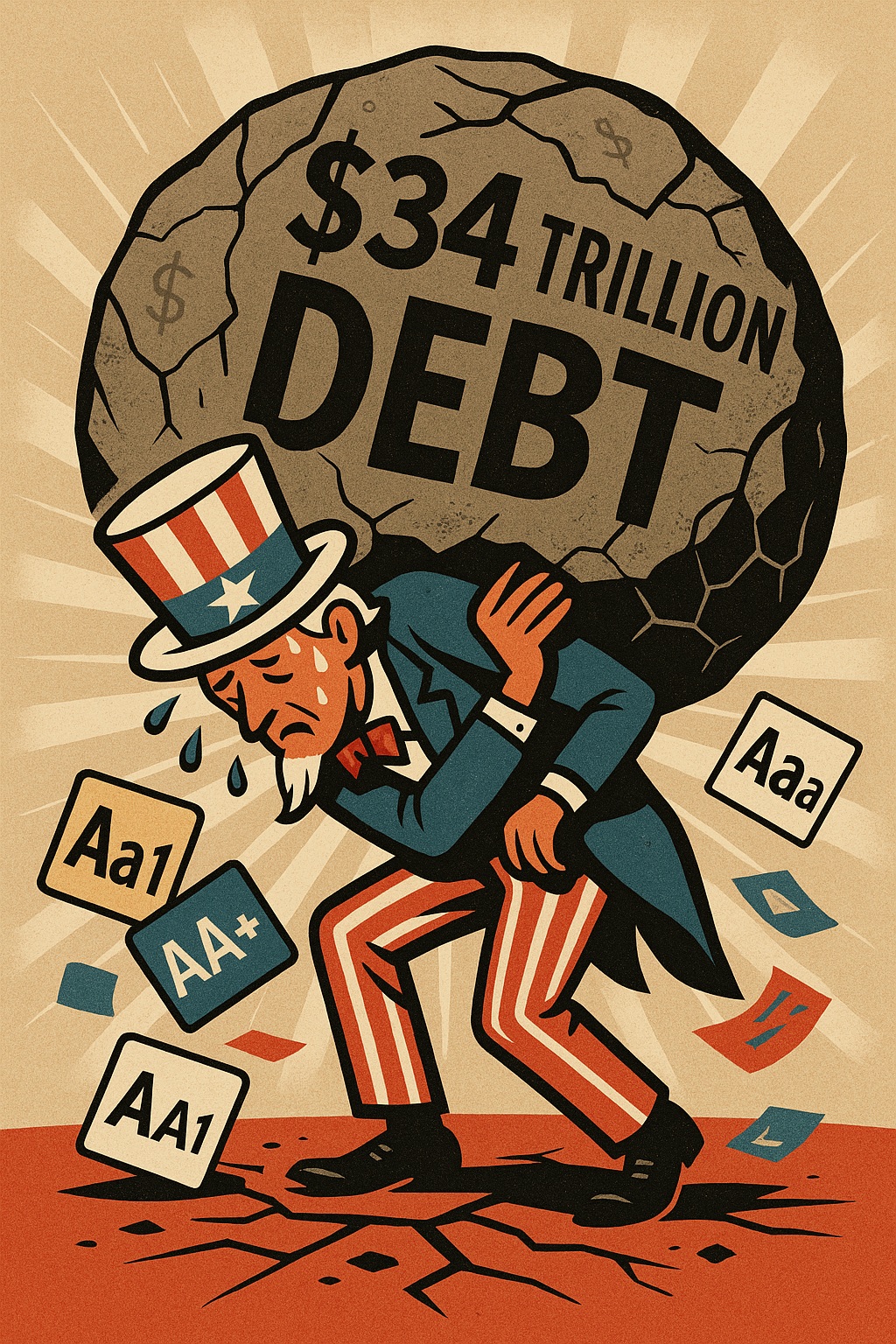

For the first time in history, Moody’s has stripped the United States of its perfect credit score. Today, May 16th, 2025, the rating agency downgraded the U.S. from its coveted Aaa rating to Aa1, sending ripples through financial markets worldwide.

This isn’t just another financial headline. This historic move marks a turning point for America’s economic standing and could affect everything from government borrowing to your mortgage rate.

What Just Happened to America’s Credit Rating?

Think of a credit rating as a financial report card. Until yesterday, the U.S. had maintained a perfect “A+” in Moody’s eyes. Now, they’ve dropped to an “A.”

Specifically, Moody’s lowered the U.S. sovereign credit rating from Aaa (the highest possible rating) to Aa1. While still considered high-quality with very low credit risk, the downgrade signals that Moody’s sees increased concerns about America’s financial health.

The silver lining? Moody’s also changed the outlook from negative to stable. This suggests they don’t expect to downgrade the U.S. again anytime soon.

To put this in perspective, Aaa ratings are reserved for borrowers with minimal credit risk – the financial equivalent of a perfect 850 credit score. An Aa1 rating still indicates high creditworthiness but acknowledges slightly elevated risk factors.

Why Did Moody’s Downgrade the U.S. Now?

While the latest announcement didn’t detail specific reasons, previous reports from Moody’s highlighted growing concerns about U.S. fiscal policies and mounting debt.

America’s debt situation has been flashing warning signs for years. High tariffs, unfunded tax cuts, and significant economic risks have all contributed to fiscal deterioration.

What’s particularly notable is that Moody’s had maintained the U.S. at its highest rating through numerous economic challenges, including the 2008 financial crisis and the COVID-19 pandemic. For them to downgrade now suggests serious concern about the direction of U.S. fiscal policy.

The rating change follows a pattern of increased scrutiny of America’s financial management. In March 2025, Moody’s had already placed the U.S. on a negative outlook, effectively putting the government on notice that a downgrade might be coming.

How Does America Compare to Other Countries Now?

The U.S. isn’t alone in facing rating challenges. However, this downgrade does alter America’s standing in the global financial hierarchy.

According to trading economics data, Standard & Poor’s (S&P) already rates the U.S. at AA+ with a stable outlook – roughly equivalent to Moody’s new Aa1 rating. Fitch Ratings has also expressed concerns about rising U.S. debt levels.

Countries that still maintain top-tier Aaa/AAA ratings across major agencies include Germany, Australia, and Singapore – nations known for fiscal discipline and strong economic management.

What’s particularly striking is that the U.S., as the world’s largest economy and issuer of the global reserve currency, now ranks below several smaller economies in terms of creditworthiness.

What This Means for Your Money

The impact of this downgrade will ripple through the economy in several ways:

Government Borrowing Costs: When a country’s credit rating falls, it typically needs to pay higher interest rates to borrow money. This could increase the cost of servicing America’s already massive debt.

Market Reactions: While markets often price in expected changes, the official downgrade could trigger reassessment of risk premiums on U.S. assets.

Consumer Interest Rates: Government borrowing rates influence other interest rates. Over time, this could affect mortgage rates, auto loans, and credit card interest.

Dollar Strength: The U.S. dollar’s status as the world’s reserve currency provides many economic advantages. Any perceived increase in risk could potentially weaken the dollar’s position.

For investors, this development requires careful portfolio assessment. Treasury bonds may see yield adjustments as markets digest this new reality about America’s creditworthiness.

What Needs to Happen Next?

According to Moody’s rating methodology, several factors could influence future rating decisions:

Fiscal Discipline: Meaningful reduction in budget deficits and a credible plan to address the national debt would be viewed positively.

Economic Growth: Strong, sustainable economic growth would improve debt affordability metrics.

Political Stability: Effective governance and policy predictability are crucial rating factors.

The stable outlook suggests Moody’s believes the situation has stabilized for now. However, regaining the Aaa rating would require significant fiscal reform and demonstrated commitment to debt sustainability.

The U.S. has faced credit challenges before. In 2011, S&P downgraded the U.S. from AAA to AA+, yet the economy continued to function and eventually strengthened. The key difference now is that with two major agencies expressing concerns, the pressure for fiscal reform grows stronger.

The Bottom Line

Despite the downgrade, the U.S. remains one of the world’s strongest economies. An Aa1 rating still represents high creditworthiness with very low risk.

However, this historic action by Moody’s serves as a wake-up call. America’s fiscal challenges – growing debt, persistent deficits, and political gridlock around budget priorities – have real consequences.

For investors and financial markets, this downgrade reinforces the importance of diversification and risk management. While U.S. Treasury securities remain among the world’s safest investments, the notion of “risk-free” is being redefined.

The coming months will reveal whether this credit rating action serves as a catalyst for meaningful fiscal reform or becomes another warning sign that goes unheeded. Either way, it marks a significant moment in America’s economic story – one that smart investors will monitor closely.

Keep an eye on upcoming federal budget negotiations, debt ceiling discussions, and fiscal policy announcements. These will provide important clues about America’s financial future and, by extension, your own investment landscape.