Today, April 4th, U.S. stock markets dropped—hard.

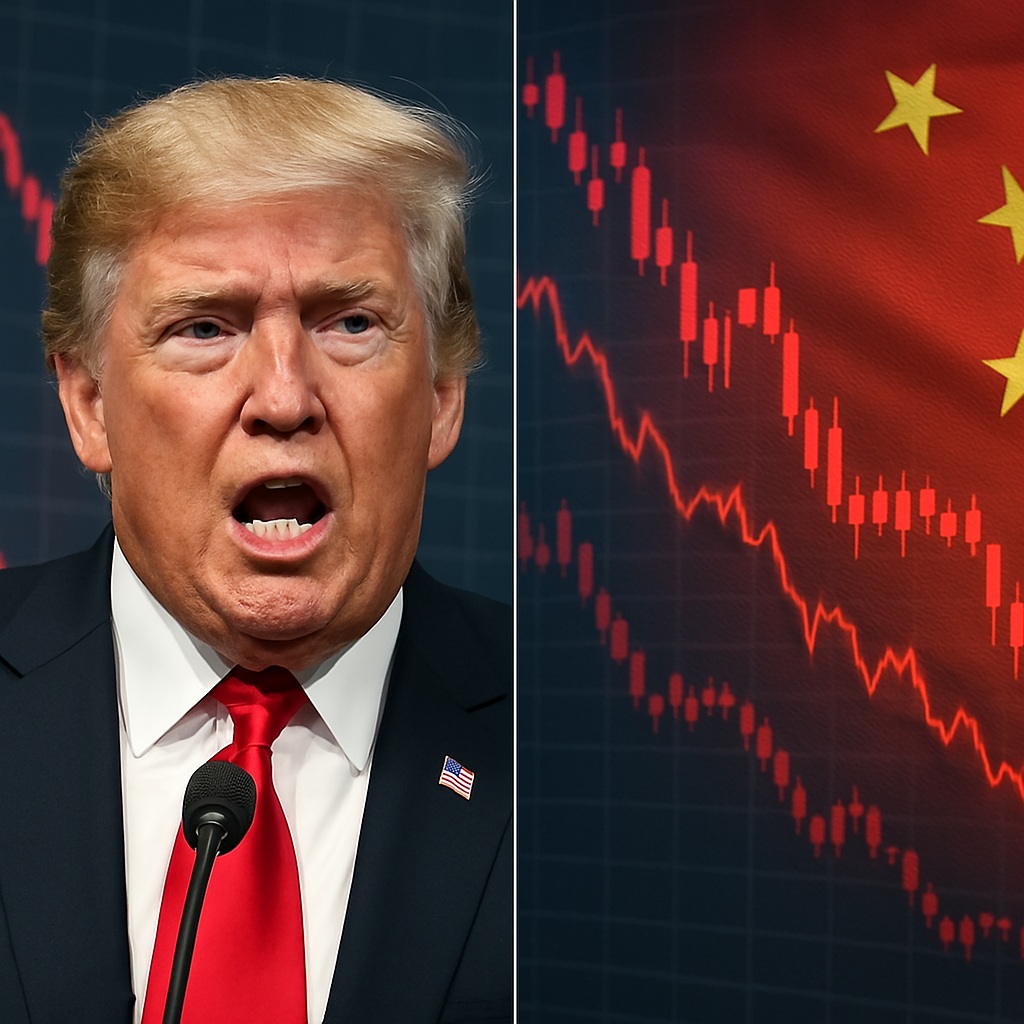

You’ve probably seen the headlines. The red numbers. The panic. But why? Why did the Dow fall over 2,200 points? Why did the Nasdaq crash almost 1,000 points in a single day? What happened?

The answer, like most market meltdowns, isn’t just one thing. But the biggest reason?

Tariffs.

Markets Got Slammed

Here’s the damage.

The Dow Jones fell 5.5%, closing at 38,314.86.

The S&P 500 dropped 5.97% to 5,074.08.

The Nasdaq? Down 5.82%. It ended the day at 15,587.79.

These are not small numbers. These are gut-punches. This was one of the worst market days since COVID.

More than 400 stocks in the S&P 500 dropped. That’s not a normal day. That’s a wipeout.

What Caused the Crash?

President Trump announced huge tariffs on Chinese goods—up to 54%. China hit back with 34% tariffs on U.S. products. And all of it happened fast.

Traders weren’t ready.

They saw “trade war” all over again. They sold. Fast.

Even big tech names like Tesla, Amazon, and Nike saw their prices sink 6–7% in after-hours trading.

This wasn’t a dip. This was a rug pull.

What Did the Fed Say?

Jerome Powell, head of the Federal Reserve, didn’t help calm anyone.

He said tariffs could raise inflation and slow down the economy. That could mean the Fed won’t cut interest rates soon.

Which is exactly what Trump wants. In fact, he posted on Truth Social asking the Fed to cut rates right now. He said inflation is down, energy prices are down, and even egg prices are down 69%.

But the Fed doesn’t move fast when it’s nervous. And right now? It’s nervous.

Jobs Are Up… But No One Cares

March job numbers were solid. 228,000 jobs added. Unemployment held at 4.2%.

Normally, that’s good news. This time, though, markets ignored it.

Because when tariffs come in that hard and that fast, good jobs data isn’t enough to keep investors calm.

Social Media Lit Up

People on X (yeah, that’s what Twitter’s called now) are already keeping track of the damage.

One post said since February 19, the Dow has dropped 12.6%. The Nasdaq? Down 21.2%.

Another user reminded everyone that 40% of the S&P 500’s earnings come from other countries. So when trade falls apart? Big U.S. companies feel it hard.

Someone else said: these tariffs could be worse than what we saw in 2018. And they want the U.S. and China to get back to the table. Fast.

It’s Not Just the U.S.

Markets around the world dropped too.

- FTSE 100 in the U.K.: down 4.95%

- DAX in Germany: down 4.95%

- Hang Seng in Hong Kong: down 1.52%

- Nikkei 225 in Japan: down 2.75%

This isn’t just a U.S. thing. It’s global.

Investors everywhere are watching the U.S.-China situation like hawks. They’re hoping this doesn’t spiral.

What’s Next?

April 5 is a Saturday. Markets are closed. But that doesn’t mean it’s quiet.

Everyone’s watching what might happen when trading opens again Monday.

Will the U.S. soften its stance? Will China? Will the Fed say more?

Or will we see more drops?

Nobody knows for sure. But the market doesn’t like surprises. And right now, there are a lot of them.

One More Thing

The VIX—the “fear index”—jumped 50.93% to 45.31.

That’s a big spike. It means traders expect more swings. More pain. More trouble.

It also means one thing: buckle up.

Final Thought

These aren’t normal market moves. This isn’t noise.

This is a major reaction to a major policy shift. And if the U.S. and China don’t find a way to ease tensions soon, the next few weeks could be rough.

For investors? Now’s the time to pay close attention. Because markets aren’t just moving—they’re screaming.