GameStop is back in the spotlight. Again. Not in a loud, wild way like in 2021, but in a quieter, slow-burning kind of way. If you’re holding GME, or just watching from the sidelines, now’s the time to pay attention.

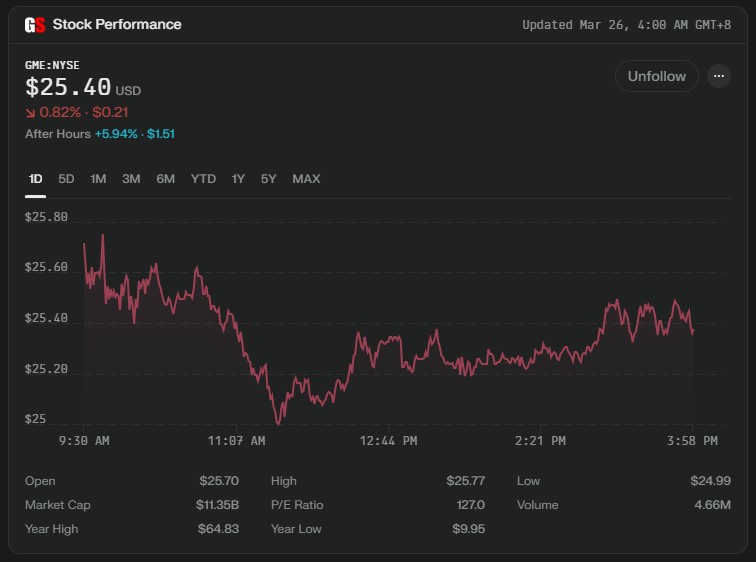

The price sat at $25.38 as of March 25, 2025. It dipped a bit—down 0.82% or about $0.21. Nothing major, but maybe enough to make some folks glance twice. It bounced around that day, from $24.99 to $25.77. So what does that even mean?

Let’s break it down.

Is GME Still Moving?

It’s not doing a crazy rally, that’s for sure. But it’s not flat either. GameStop’s been trading in a tight range, kinda like a dog pacing the same hallway, waiting for someone to open the door. The trading volume came in at 4.66 million shares, which is actually lower than its average—usually around 6.05 million. That might tell you something. Maybe folks are just waiting… for what?

For earnings.

And now, maybe for Bitcoin too.

GameStop Just Bought Bitcoin

This just dropped: GameStop has added Bitcoin to its balance sheet.

Yeah, you read that right. On March 25, 2025, the same day everyone was watching for earnings, the company announced a major policy change—they’re now holding Bitcoin as a treasury reserve asset. Board-approved. Public. Official.

With about $4.75 billion in cash, that’s no small move. The crypto community took notice fast. Michael Saylor himself even welcomed CEO Ryan Cohen to “Team Bitcoin.”

Some are calling this a major shift in GameStop’s financial strategy. Others are already speculating it could boost Bitcoin’s price long term. Either way, this changes the GME conversation.

Why Is Everyone Watching March 25?

Earnings. That’s why. GameStop’s dropping its Q4 2024 report after the market closes on March 25. And yeah, it matters. A lot.

Because Q4 covers holiday sales. For retailers like GameStop, that’s the big one. If they didn’t do well then, it’s not a great sign.

Also, it’s not just this one report. They’ve already laid out dates for the rest of the year:

- Q1: June 6

- Q2: September 9

- Q3: December 9

All after market close. Clean and predictable. That helps investors plan. But still… what actually changes?

So… What’s the Market Saying?

Right now, the price kinda sits between a couple of key moving averages:

- 50-day average: $25.80

- 200-day average: $25.12

That’s close. Really close. It says the stock hasn’t gone wild in either direction lately. It’s just… sitting. Maybe building pressure. Or maybe cooling off.

Also, GME’s P/E ratio is 127. That’s big. Way bigger than most retail companies. And its EPS is $0.20. So it’s making money—barely. But people are paying a premium for the stock, not because of current earnings, but maybe what they think is coming.

And now with Bitcoin in the mix? That premium might start to make more sense—to some investors anyway.

Are Analysts Bullish or Bearish?

Mostly bearish.

A couple analysts bumped their price targets up recently:

- One to $27

- Another to $26

But they still kept bearish ratings. So… they expect it to go up a little, but not for long. It’s like giving someone a pat on the back, then walking away. Not exactly a cheer.

What’s Coming Next?

Some forecast models show GME at $27.23 by the end of March. That’s about an 8.7% gain from where it started. Then maybe $29.15 in April. Sounds good, right?

But in May, a drop. Down to $27.13.

And further out? Predictions say the stock might hit $34.59 by December 2025. Some even say $52+ by mid-2026, maybe even $59.82. Then a dip again. Back into the $31–$34 range by 2027.

That’s a rollercoaster. Up. Down. Up. Then down again.

What Could Actually Move This Stock?

A few things. Not all of them are obvious.

1. Investor Memory.

People remember 2021. That wild squeeze. The Reddit hype. Even if the short interest is way lower now, the memory still lingers. That alone can drive behavior.

2. Bitcoin Exposure.

This could be huge. If Bitcoin runs, GME could ride the wave. If Bitcoin drops, same thing in reverse. Now, GME isn’t just a retail play—it’s a Bitcoin proxy too.

3. E-commerce Transition.

Ryan Cohen’s push to move GameStop online could still pay off. If the company shows real progress there—like actual growth in digital sales—that could move the price.

4. Retail Speculation.

Platforms like Robinhood still exist. So do TikTok and Reddit. If GME trends again, it won’t take much to spark a buying wave. It doesn’t have to be based on logic. It just has to be loud.

5. Valuation Multiples.

Some recent gains came from improved price-to-sales ratios. That just means people are willing to pay more for each dollar of sales. If that keeps going, the price could follow.

6. Analysts.

Even bearish analyst notes can shift perception. People still look at price targets. Even if they disagree, it creates movement.

Should You Buy, Hold, or Avoid?

That’s up to you.

But here’s what’s clear:

The price is in a holding pattern. Earnings are the next big event. Analyst targets are cautious. Forecasts suggest upside… but with big corrections.

Now there’s a new variable—Bitcoin. That could be a game changer. Or it could add more volatility to an already unstable stock.

If you’re looking for a steady, safe play? This ain’t it.

If you like volatility and timing the waves? Keep watching.

If you believe in Ryan Cohen’s long game and Bitcoin’s upside? Then maybe this is still your bet.

But whatever you do, don’t go in blind. Watch what happens after earnings. Look at volume. Read management’s guidance.

GameStop isn’t dead. But it’s not exactly winning yet either.

And if it does start to run again…

you probably won’t get much warning.