At the time of writing this post, May 6th, the U.S. and China are not officially talking trade, but the world is watching closely. Despite signs of possible progress, deep distrust and opposing demands are keeping the two largest economies at a standstill.

Both countries have made small moves that suggest they’re open to negotiation. But there’s one major roadblock: tariffs.

No Formal Talks—But Subtle Signals

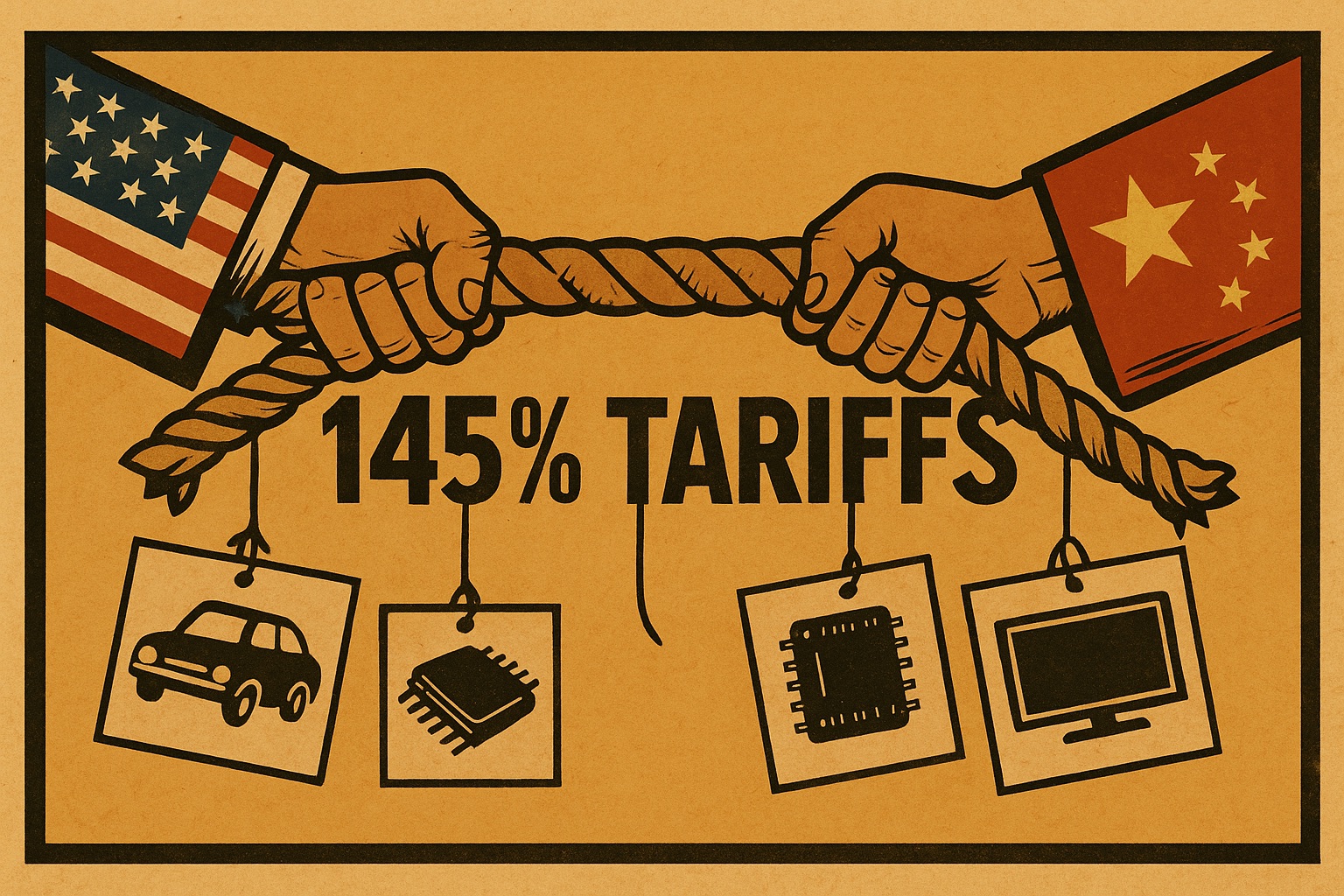

According to China’s Ministry of Commerce, China is “evaluating” the idea of talks. But they’ve made their stance clear: no real discussions unless the U.S. cancels its steep tariffs on Chinese goods, some of which now sit above 145%.

On the other hand, the U.S. government says it’s trying to open dialogue. Treasury Secretary Scott Bessent and Secretary of State Marco Rubio have both pushed for talks, arguing that the tariffs are unsustainable for China and a deal is still possible.

But confusion remains. President Trump has repeatedly claimed that negotiations are already underway. China denies this, stating there are “absolutely no negotiations” happening right now.

This disconnect has created a fog of uncertainty, leaving analysts and investors unsure whether backchannel discussions are actually taking place.

The Tariff Standoff

At the heart of the conflict is a question of who moves first.

China is holding firm. It won’t come to the table unless the U.S. removes tariffs, according to CNBC. But the U.S. isn’t ready to offer major concessions without something in return.

This chicken-and-egg problem is keeping both sides from formally engaging. Neither wants to look weak or lose leverage, especially with so much political weight behind the issue.

Steps Toward De-escalation

Still, actions on both sides suggest an effort to cool tensions.

In recent weeks, the U.S. signed an executive order that exempted cars and electronics from tariffs. China followed with waivers on U.S. pharmaceuticals, semiconductors, aerospace equipment, and ethane, key sectors for both trade and innovation.

These moves are small, but strategic. While not a sign of full-scale negotiation, they hint that each side may be preparing for eventual talks.

How Markets Are Reacting

Financial markets are showing cautious optimism.

After China’s May 2nd statement, the offshore yuan rose 0.14% against the dollar. The Hang Seng index climbed 1.6%. Investors took these signs as steps toward easing the trade war.

Still, the larger risks haven’t gone away. If the stalemate drags on, it could further isolate the two economies and reshape global trade patterns in irreversible ways.

Experts Say: It Won’t Be Quick

Policy analysts don’t see a fast fix.

Dan Wang of Eurasia Group predicts a “long-lasting painful truce,” where both sides avoid further escalation—but don’t fully agree either. Alfredo Montufar-Helu from The Conference Board expects China to push for tariff levels to go back to pre-“liberation day” levels, though that could take months.

Tianchen Xu of the Economist Intelligence Unit says both countries are “waiting for the other to blink,” though he believes a working-level process could slowly bring tariffs down to 40%-50% within the next two quarters.

Bottom line: any deal will likely take time and come in stages.

Summary Table: Where Things Stand

| Entity | Position | Recent Actions |

|---|---|---|

| China | Will talk only if U.S. cancels tariffs | Granted waivers on U.S. goods like semiconductors, pharma |

| United States | Open to talks, but tariffs still in place | Exempted some imports (cars, electronics) from tariffs |

| Analysts | Expect slow, complex progress | Predict staged de-escalation over months, not weeks |

What’s Next?

The trade war isn’t over. In fact, some believe it’s entering a new phase—one of quiet repositioning and tactical moves, rather than bold announcements or deals.

As both countries weigh the economic fallout of continued tariffs, the global community waits. Will either side make the first real move? Or will the world see a long, drawn-out cold truce with no clear resolution?

For now, the answer is as political as it is economic.