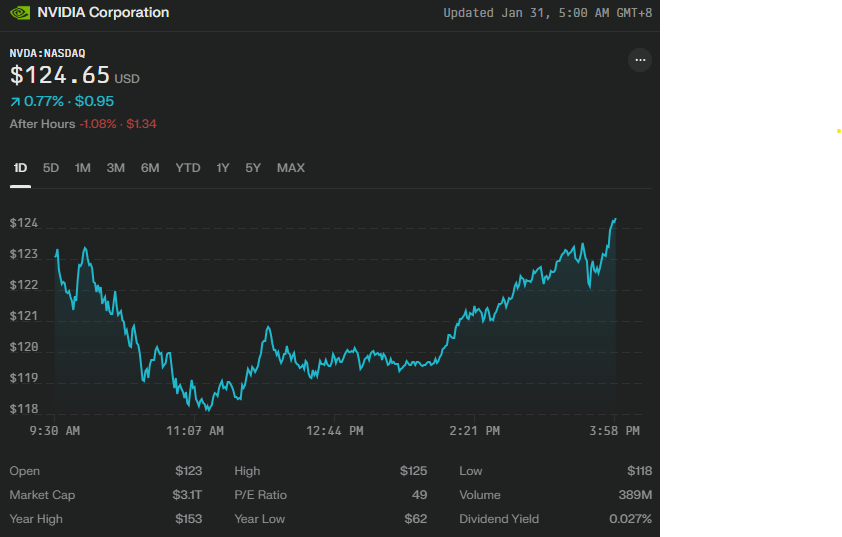

Nvidia, the once-unstoppable titan of the AI revolution, experienced a seismic shock this week, a dramatic fall that sent ripples through the entire tech sector. In a single day, the company witnessed a breathtaking 17% plummet, wiping out nearly $600 billion in market capitalization – the largest single-day loss for any U.S. company in history. While the stock has since rebounded slightly, trading at $124.65 as of January 30th (a 0.95% increase from the previous day), the lingering tremors raise critical questions about the future of the AI landscape and Nvidia’s place within it.

The earthquake began with the emergence of DeepSeek, a Chinese AI startup that’s shaking the foundations of Nvidia’s dominance. DeepSeek’s newly unveiled AI model boasts performance comparable to Nvidia’s flagship offerings, but at a significantly lower cost. This David-versus-Goliath scenario has sparked widespread concern among investors, who are now grappling with the potential for significant market share erosion. The whispers of a cheaper, equally effective alternative have ignited a firestorm of uncertainty, leaving many wondering if Nvidia’s previously unassailable lead is finally vulnerable.

Adding fuel to the fire are troubling technical indicators. Nvidia’s stock has dipped below its crucial 200-day moving average for the first time since January 2023, a bearish signal that has sent shivers down the spines of many seasoned traders. Analysts are closely watching this key level; a failure to regain traction above $130 could trigger further declines, with potential support levels identified around $110 and $100. The path ahead looks precarious, a tightrope walk requiring a significant rebound to avoid a deeper plunge.

The situation is further complicated by the tightening regulatory noose. The Biden administration’s new export restrictions on advanced AI chips, limiting sales to certain countries, have added another layer of complexity. Given Nvidia’s substantial international revenue stream, particularly from China, these regulations pose a significant threat to future growth prospects. This geopolitical chess game adds an unpredictable variable to an already volatile equation.

Nvidia’s upcoming earnings report on February 26th will be scrutinized with unprecedented intensity. Investors are desperately seeking clarity amidst the storm. While some analysts remain optimistic, pointing to Nvidia’s strong position in large-scale AI infrastructure projects, others warn that the recent market reaction may be a justified reflection of intensifying competition and regulatory hurdles.

The narrative unfolding before us is a compelling blend of technological innovation, geopolitical maneuvering, and market sentiment. While Nvidia’s recent slight recovery offers a glimmer of hope, the underlying challenges remain formidable. For investors, the message is clear: proceed with caution. The AI landscape is evolving rapidly, and the battle for supremacy is far from over. The coming weeks will be crucial in determining whether Nvidia can weather this storm or succumb to the pressure from rising competitors and shifting regulatory sands.