For most Americans, April 15, 2025, is still the deadline to file 2024 federal income tax returns. But for millions of people impacted by natural disasters, that date just changed.

If you live in Arkansas, Tennessee, California, or one of several FEMA-declared disaster areas, you could have until November or even October to file.

Let’s break down what’s changed, who qualifies, and what you need to know to stay compliant—and avoid costly penalties.

The Standard Deadline Still Stands

Unless you’re in a federally declared disaster area, your due date to file taxes is still April 15, 2025. That applies to both filing your return and paying any taxes you owe.

If you need more time to prepare your return, you can request an extension using IRS Free File. But that only buys time to file—not to pay. Late payments still rack up penalties and interest after April 15.

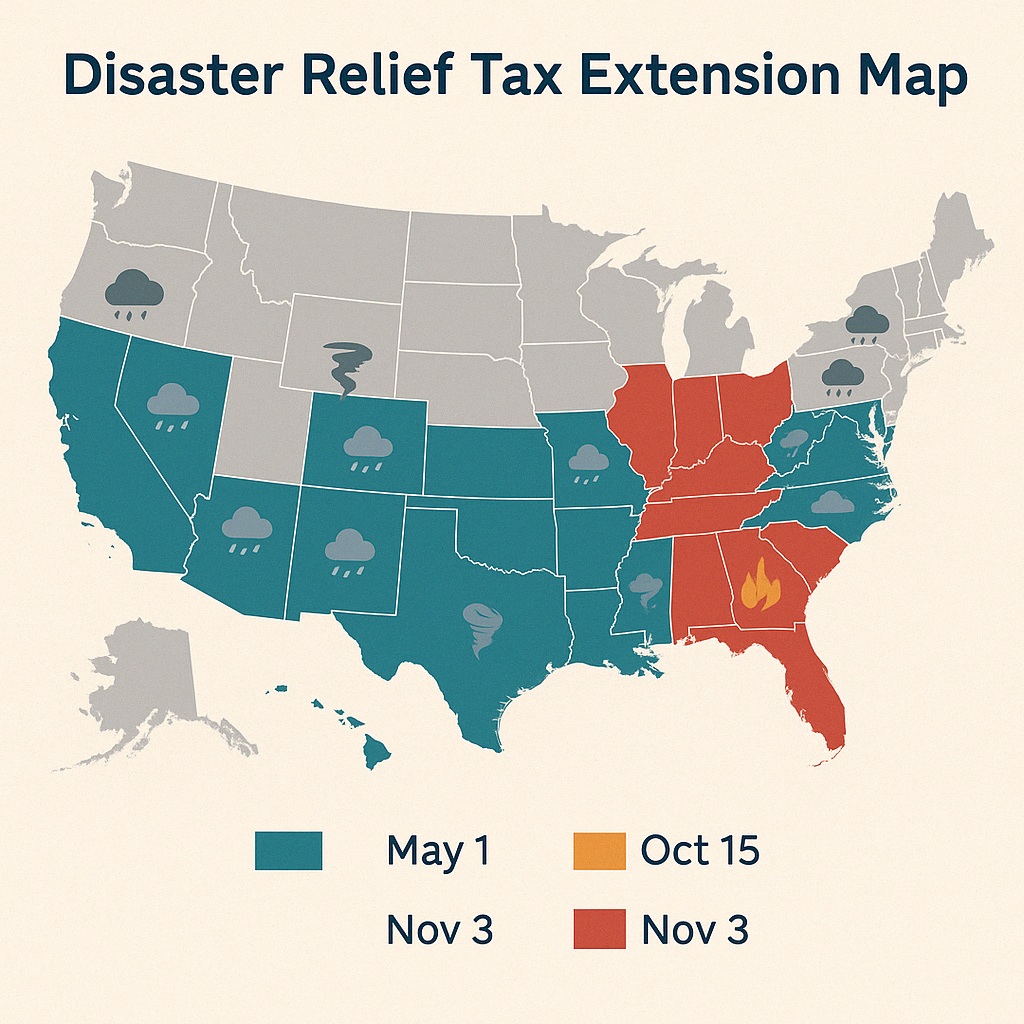

New Disaster Relief Extensions Announced

The IRS has granted automatic deadline extensions to several areas affected by recent storms, wildfires, and other disasters. No action is needed if your address is on file in the covered counties—relief is automatic.

Here are the major changes:

1. Arkansas and Tennessee: November 3, 2025

On April 14, 2025, the IRS announced that all counties in Arkansas and Tennessee are now eligible for disaster tax relief.

This follows severe storms, tornadoes, and flooding that began on April 2. The new deadline to file and pay 2024 taxes is November 3, 2025.

The IRS Arkansas Relief and IRS Tennessee Relief pages list full details, including:

- Extended deadlines for 2024 income tax returns

- Relief for quarterly estimated payments due April 15, June 16, and September 15

- Penalty waivers for payroll and excise tax deposits if made by April 17

This relief also allows taxpayers to claim disaster-related losses on either their 2024 or 2025 tax returns, with an election deadline of October 15, 2026.

2. Southern California Wildfires: October 15, 2025

If you’re in Los Angeles County, you’ve likely been impacted by the devastating wildfires from January 2025.

The IRS has extended the filing deadline for these taxpayers to October 15, 2025. This applies to all federal tax filings, including individual returns and business taxes.

3. West Virginia: November 3, 2025

Several parts of West Virginia also qualify for disaster extensions due to 2025 storms, flooding, and landslides.

Affected counties received the same extended deadline of November 3, 2025. Relief covers individual filings, estimated payments, and business-related tax obligations.

4. Nine States Affected by 2024 Disasters: May 1, 2025

If your area was hit by a federally declared disaster in 2024, your deadline is May 1, 2025.

This extension applies to parts of Alabama, Florida, Georgia, North Carolina, South Carolina, Alaska, New Mexico, Tennessee, and Virginia.

You can check if your area qualifies by visiting CBS News’ coverage or using FEMA’s disaster declarations site.

Filing Extensions for Everyone Else

If you’re not in a disaster area but still need time, you can file for an extension by April 15, 2025, at IRS Free File or by mailing Form 4868.

Just remember—this only gives you until October 15, 2025, to file your return. You still have to pay what you owe by April 15 to avoid penalties.

Help Is Available

If you’ve been impacted by a disaster and need tax support, here are some resources:

- Call the IRS Disaster Hotline at 866-562-5227

- Visit DisasterAssistance.gov for aid and updates

- Get free tax prep help through VITA or TCE programs

- Check IRS.gov for updates on current relief

If your IRS address is incorrect or you’ve moved since the disaster, make sure to update it quickly so you don’t miss out on automatic relief.

Why This Matters

According to Time and Axios, the IRS is processing returns at a pace similar to last year, despite staffing issues.

But analysts predict tax receipts could fall by 10%—a hit of over $500 billion—largely due to delayed payments in disaster-affected areas.

These extensions don’t just offer flexibility—they’re critical for families and businesses trying to recover.

Final Thoughts

If you’re in a disaster zone, you have more time—use it wisely.

If you’re not, don’t wait. File or request your extension by April 15 to stay on track and avoid penalties.

And if you’re unsure about your filing status or eligibility, double-check your address, consult the official IRS relief pages, and get help early. Being informed today can save you money—and stress—later.