On May 3rd, 2025, Warren Buffett took the stage in Omaha for what may be his most important annual meeting yet. Known as the “Woodstock for Capitalists,” the Berkshire Hathaway gathering has always been a spectacle, but this year was different.

Not just because of the record-breaking 19,700 people who showed up. Not because of the See’s Candies stand that pulled in over $300,000. And not even because of the sold-out 60th-anniversary book about Buffett himself.

This year marked a turning point for the future of Berkshire Hathaway.

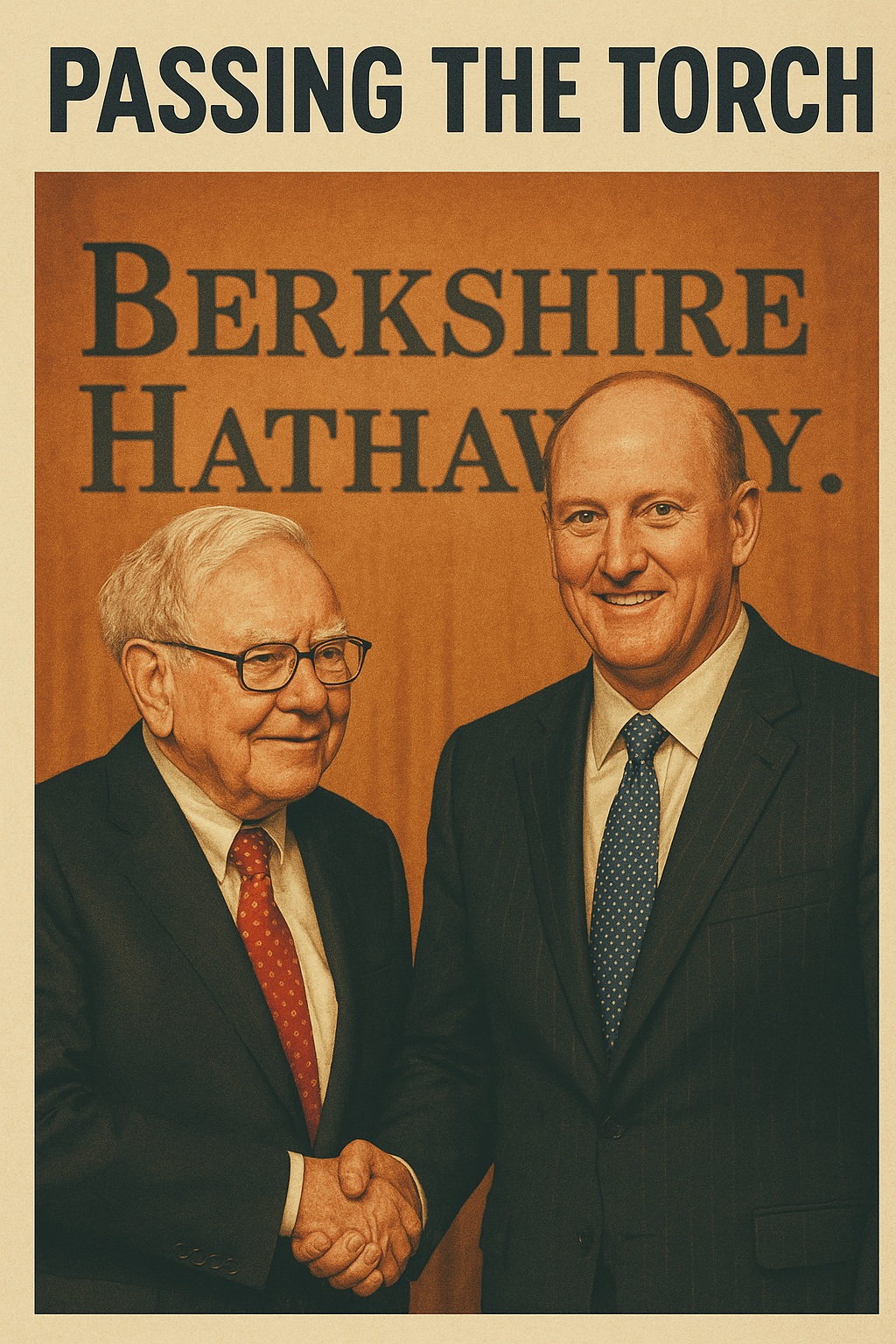

The Big Shift: Buffett Names Greg Abel as Successor

The headline moment came when Buffett announced his intention to ask the board to make Greg Abel the CEO of Berkshire Hathaway by the end of 2025. Abel, who currently serves as vice chairman of non-insurance operations, will take over core responsibilities—capital deployment and operations—while Buffett remains involved behind the scenes.

Abel, 62, wasn’t expecting the announcement to be made at the meeting. But investors weren’t surprised. For years, Buffett hinted at a succession plan, and now it’s official: Abel is the one carrying the legacy forward.

Buffett made it clear he won’t be selling his shares. Instead, he’ll continue giving them away gradually, showing his trust in Berkshire’s direction under Abel’s leadership.

Earnings Take a Hit: A Tough First Quarter

Berkshire’s Q1 2025 operating earnings dropped 14%, down to $9.64 billion from $11.22 billion last year. That’s $4.47 per share—lower than both UBS ($4.89) and FactSet ($4.72) projections.

See the official earnings report.

The reasons? Lower profits from insurance underwriting and foreign exchange losses. The company also took a $1.1 billion hit from Southern California wildfires.

Add to that Buffett’s warning about tariffs, which he said create “considerable uncertainty” for operating results, especially given rapidly changing trade policies.

Buffett on the Economy: Calm Words in a Chaotic World

Buffett had strong words about the global economy—and the direction of U.S. policy.

First, he pushed back on tariffs and protectionism, saying trade should not be used as a weapon. He emphasized the importance of focusing on what the U.S. does best and trading freely.

He also downplayed recent market volatility, calling it “really nothing.” According to him, Berkshire stock has been cut in half multiple times over the decades, and this moment is no different.

But Buffett didn’t hold back on one issue: the U.S. budget deficit. He called it “unsustainable,” pointing out that Congress has yet to take meaningful action.

$347 Billion in Cash—and No Rush to Spend It

Despite recent earnings pressure, Berkshire’s financial position is as strong as ever. The company holds a record $347 billion in cash, up from $334.2 billion last year.

They almost made a $10 billion move—but held back.

Buybacks have slowed, partly due to a new 1% excise tax. Instead, Buffett signaled that Berkshire is holding out for the right opportunities in the next five years.

This kind of patience isn’t just Buffett being cautious. It’s a signal: he sees something coming, and Berkshire wants to be ready.

What About AI? Jain Says It’s a “Game Changer”

Ajit Jain, Berkshire’s vice chairman of insurance operations, spoke about AI’s potential in the insurance world.

He didn’t make any bold promises but said the company is in a “state of readiness.” They’re watching. They’re waiting. But they’re not diving in just yet.

Geico, meanwhile, has already transformed. Under Todd Combs, the workforce shrank from 50,000 to 20,000, saving $2 billion annually. It’s a clear example of how Berkshire is quietly streamlining operations while positioning for what’s next.

Japan, Forever? Buffett Thinks So

Buffett reaffirmed that Berkshire has no plans to sell its investments in Japan, including stakes in Mitsui, Mitsubishi, and others. In fact, he sees these as 50-year bets, rooted in strong performance and trusted relationships.

It’s classic Berkshire: go long on quality, don’t chase trends.

Cultural Capital: Buffett’s Legacy on Display

The shareholder bazaar saw See’s Candies pull in $317,000, Brooks bring in $310,000, and Jazwares hit $250,000. And the 60th-anniversary Buffett book sold out—4,400 copies gone in a day, some auctioned for charity.

These aren’t just feel-good numbers. They show how deep the Berkshire community runs, and how much people care about this company, not just for its stock, but for what it represents.

What’s Next for Berkshire Hathaway?

With Greg Abel stepping into leadership, a mountain of cash waiting for action, and Buffett still guiding from behind the scenes, Berkshire Hathaway is entering a new chapter.

It’s not a reinvention. It’s a quiet evolution.

Investors will be watching closely—not just for what Berkshire buys, but how it balances risk, innovation, and legacy under new leadership.